Purpose

We’ll be talking about VirTra today — a micro-cap that’s focused on using virtual reality to train police officers. No idea why they are named that way. By the end of this post you’ll understand the business, future growth prospects, near term headwinds, a fair valuation, it’s moat, and the presence of an asymmetric risk reward opportunity which I love.

The Business

VirTra (VTSI) is a company that specializes in providing advanced training simulators for law enforcement, military, and commercial markets worldwide. VirTra offers high-fidelity use-of-force and firearms training simulators. Their flagship products include the V-300, a 300-degree wrap-around screen simulator, and the V-180, a 180-degree screen simulator. They also provide single-screen systems like the V-100 and V-ST PRO for smaller spaces or budgets. You can see some of these here.

Some of their big clients include the Los Angeles PD, Chicago PD, Dallas PD, and San Francisco PD. As of 2022, VirTra reported deploying systems in over 1,200 locations worldwide. I couldn’t find a more recent number but they do mention their TAM for the law-enforcement sector: around 650 million $. Police departments use their systems for Use of force scenarios, De-escalation training, and Critical decision-making under stress.

We live in a time where the Police departments have a horrible reputation around the country and more fuck-ups like Rodney King or George Floyd will not be tolerated by the public. Seeing this, The Department of Justice reserved almost 15% of $334 million in federal grants for de-escalation training, translating to over $43.6 million in funding. So there’s lots of room to grow.

Now let’s talk about reviews. Do the police departments like this stuff? The answer is a resounding yes as seen here. Knoxville Police Department Chief Paul Noel described the VirTra Simulator as a "total game-changer" that has the potential to "completely revolutionize" their training. You can see more news articles, reddit threads, and reviews for yourself. What’s more? Their customer retention is a stunning 95%.

With only 112 employees, the company is quite lean too. Looking at the glassdoor reviews, I see that the employees are happier since Givens became the sole CEO in 2023. The reviews mention that they are doing great things.

The Stock

Very volatile. Saw a high of 16$ in May 2024 and now sits at just 6.6$. So what happened? Before May, this was a growth stock with revenues going up more than 30% YoY. But in Q1 2024, total revenue decreased by 19%. The trend continued in Q2 2024, with revenue further declining to $6.1 million, a 41% decrease compared to the same quarter in 2023.

Why did this happen? The primary reason for the revenue decline was delays in federal funding, attributed to the U.S. government's continuing resolution. This caused numerous contracts to be placed on hold. Pair this with international contracts taking longer than expected to finalize, and Mr Market panics. CEO John Givens described the situation as a "continuation of a transitional period" as the company ramped up new sales initiatives.

However, bookings doubled sequentially from Q1 to Q2, totaling $5.9 million, indicating improved market conditions and a strengthened sales approach and the company maintained a strong gross margin of 91%, up from 57% in the prior year period. VirTra remains optimistic about the latter half of the year, focusing on federal grants and military market expansion.

Future Growth Prospects

VirTra has moved to a subscription model for it’s proprietary software. So all of the police departments working with them will pay a 12 month subscription. After looking extensively, I couldn’t find any meaningful competitor for this company. Proprietary software + lack of competitors signals the possibility of a moat to me. As long as police departments in the US (and soon around the world) are using advanced technology to train their police officers, VirTra will have a place with it’s 95% retention rate.

The upcoming launch of VirTra's V-XR extended reality solution, set to begin shipping by the end of Q3 2024, is expected to be a major growth driver. It will help them expand beyond law-enforcement to military, and even new markets such as education and healthcare.

VirTra is actively pursuing larger contracts in U.S. Federal and Department of Defense channels. The company has deployed a dedicated sales team to secure these high-value opportunities, which could significantly boost revenues if successful. VirTra has also enhanced its ability to capture law enforcement dollars through an improved pipeline of federal grants, so broke police stations can also take advantage of this.

So there’s lots of runway and untapped market opportunities. Since U.S police forces have the highest budget in the world and they are using it, I am expecting international interest to catch up. With more production, the prices should come down and these products should be more affordable for everyone around the world.

Valuation

The company holds 10 million $ in cash. And the market cap is 73 million $. So we are getting the underlying business for 63 million $. In Q2 the revenue was 6 million $ which really spooked the investors. As bad as their quarter could get. So let’s say they have a bad year — at 24 million $ revenue. With a pretty consistent profit margin of 20%, this gives us a net income of 4.8 million.

So a PE ratio of 13 for the underlying business at these valuations with these horrible revenue estimates. Let’s say the market is super pessimistic and shrinks the PE to 10. This gives us a share price of 5.2 $. I’d say this is the floor of this investment.

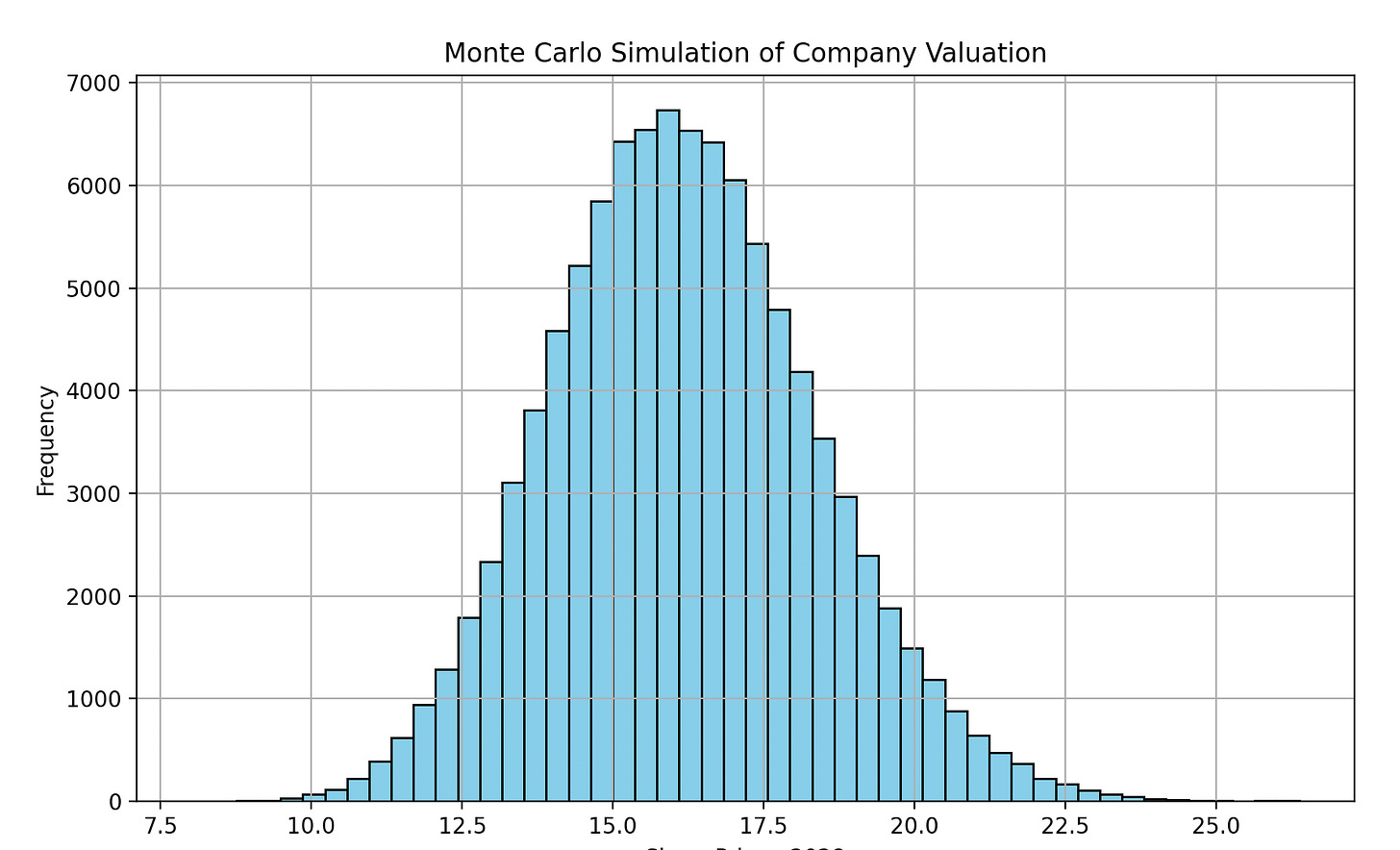

Let’s look at a case that’s slightly better. After 2 to 3 years, an annual revenue of 50 to 80 million $. Something that’s easy to achieve with all the growth prospects discussed earlier. With a profit margin of 15 to 20%. A constant share count of 11.1 million. Plugging this into a monte carlo simulator we get:

So we’ve now come across an asymmetric risk reward opportunity. With an upside of 3x or more looking likely.

Conclusion

The business looks great, seems like there’s a moat, and some great growth prospects. The valuation looks delicious. Any and all feedback is appreciated. Thank you for reading.