Purpose

This post will deal with valuation of HLF and understand the case for investing. There are many resources available to understand the business, I suggest you look at them first before proceeding. There is a special situation going on with this company and its stock which I’m trying to understand.

Point of Interest

I came across HLF because of superinvestors buying earlier. And then all of them piling on their original bet and buying the dip.

All of them are at-least 30% down but they keep adding. Looking at the insider buying pattern, I see a big positive too:

Buys and buys all round. This made me look deeper into the company’s situation and I can tell you it’s not disappointing. While it looks quite disappointing on the first look, I understand that this negativity is creating an amazing opportunity.

Sentiment

The sentiment around this stock is quite negative. It has a history of deceit and scandal so people don’t wanna touch this stock. It has a (Debt - Net Cash) of 2.1 billion dollars. So a really unhealthy balance sheet. Pair this with decreasing revenues and shrinking margins…it makes for a really bad story. People are rooting for its bankruptcy and the market is, sure enough, pricing it that way.

Why Invest

Be fearful when others are greedy and be greedy when others are fearful

- Warren Buffet

The revenue for 2023 was 5 billion dollars and management’s guidance for FY 2024 is -3.5% to +1.5% of that number. So around the same. Now let’s look at EBITDA — 520 million for 2023 and expected for FY 2024 is 550 to 600 million dollars.

So things aren’t looking great but they aren’t looking bad either. Net income for 2023 was 142 million dollars, for 2024 the guidance is not given but should be similar if not better. This is because the management has started a restructuring program to streamline operations and get rid of dead weight. Savings in 2024 are expected to be 50 million dollars and 80 million dollars in early 2025.

This should increase the Net income. Management is prioritizing two things right now: paying back that debt and expanding margin. The restructuring should help with the second. Let’s look at the first:

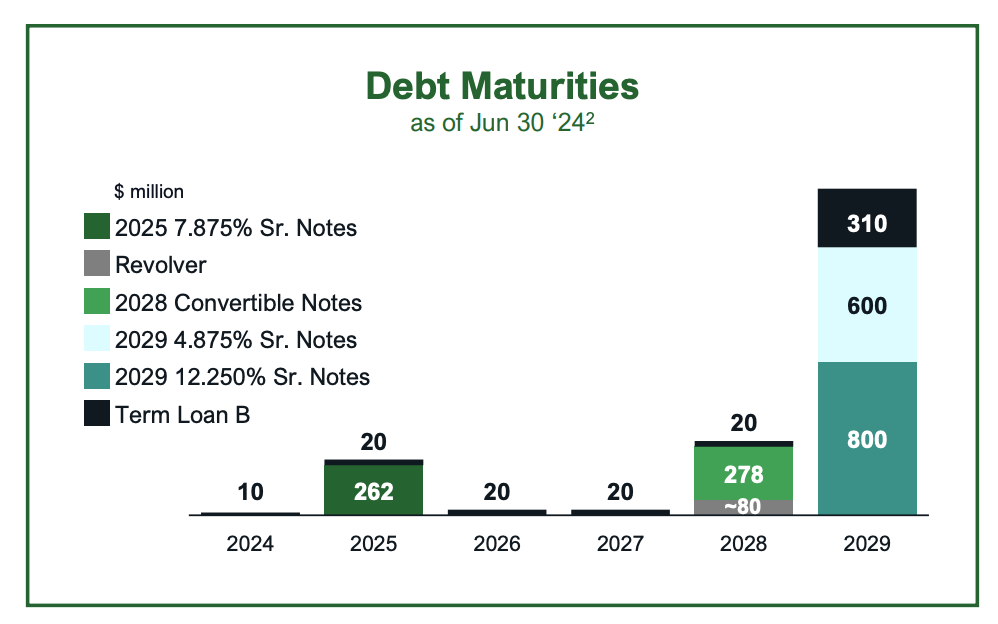

I think they’re good till 2029 which is when they have to pay back 1.7 billion dollars. Their plan is to repay 1 billion dollars of debt by 2028-2029. And they have a revolving credit facility of 400 million dollars if things go south and they don’t reach their mark.

Based on the fact that they continue to be profitable, I don’t think bankruptcy is a real risk. So by 2029 we will have a company that is 1 billion dollars in debt and earns 150 - 200 million a year. This seems reasonable.

Currently, the PE is 5 based on the 2023 Net income of 142 million. As they complete the restructuring and pay off some of that debt, I can see the market attaching a higher PE ratio around 10 with the same net income.

So yes, I’m expecting this stock to double in price to around 14$. Since bankruptcy is a very small risk, I see an asymmetric risk-reward opportunity. That is, I don’t see much downside in this investment.

Thank you for reading. All feedback is appreciated!